In February, students were shocked to find out that a beloved professor was caught embezzling thousands of dollars from a student organization. However, professors aren’t the only ones who have access to hefty university checking accounts.

A few weeks before, the president of the Native American Student Association was reported embezzling nearly $2,000 from the organization.

Around the same time professor Scott Whisnant was reported embezzling, a separate embezzlement report was filed for another employee within College of Agricultural and Life Sciences.

The number of embezzlement cases varies semester by semester, according to University Police, but this semester has seen an increase.

“This is the largest amount of embezzling we’ve seen in a while,” said University Police Chief Jack Moorman.

In 2015, there were no reports of embezzlement in which the university or a department, organization or club affiliated with the university were listed as a victim. In 2016, there have been four cases of embezzlement with six university-related victims.

Now, Student Involvement is taking the necessary measures to educate student organization leaders about healthy financial practices.

With these concerns, Student Involvement, which oversees these student organizations, held financial workshops almost immediately after Whisnant’s incident was reported. However, with very low attendance, Student Involvement is looking to educate students through online modules about how to manage an organization’s account.

Whisnant embezzled money from three student groups: Alpha Zeta, the Animal Science Club and the Agri-Life Council.

Former president of Native American Student Association, Rodney Strickland, embezzled from the organization, whose funds are made up of money appropriated by Student Government.

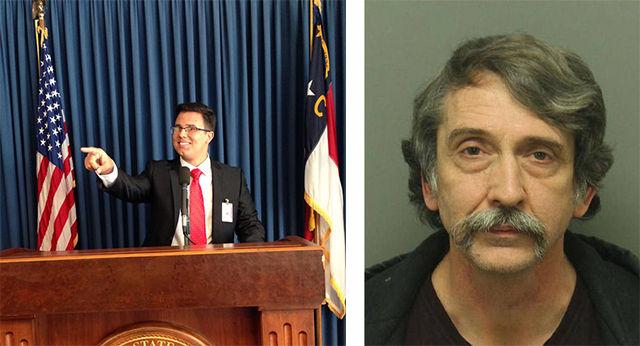

Scott Whisnant

Whisnant’s next court appearance is May 23 at 9 a.m., according to the Wake County District Attorney’s office. Whisnant faces three counts of felony embezzlement for embezzling nearly $72,000 from student organizations.

According to the search warrant, Whisnant’s intent was to use the money to help one of his former students, Lisa Mcphatter, pay for medical bills and purchase a 2015 Toyota Prius.

Multiple requests were made to Whisnant’s attorney Christian Dysart, but Dysart did not respond in time for print.

University Police seized thousands of emails between Whisnant and Mcphatter dating back to 2011. In an email to Mcphatter, Whisnant told her “not to cooperate with law enforcement.”

Whisnant embezzled money between Dec. 26, 2014 and Jan. 7 of this year, according to arrest warrants. Bank records show that Whisnant embezzled $750 from Agri-Life Council, $16,862 from the Alpha Zeta Agriculture Honors Fraternity and $54,255 from the Animal Science Club.

Whisnant resigned as a professor from the College of Animal and Life Sciences Feb. 9.

Rodney Strickland

The president of the Native American Student Association was reported to have embezzled $2,677 from the organization Jan. 25. Brittany Hunt, director of Native American Student Affairs, said the amount embezzled was wrong in the police report, but would not comment on the actual amount that was embezzled. Most of the money has been returned to the Native American Student Association, according to Hunt.

The Technician reached out to Strickland for a comment, but he declined.

No criminal charges have made against Strickland, but his case is being processed through Student Conduct, according to University Police. Strickland is still listed in NC State’s directory as a student.

Bryce Chavis, a sophomore studying economics, is listed as the vice president of the Native American Student Association on the Student Government’s Get Involved page. Multiple requests were made to Chavis to comment on the status of the Native American Student Association and current leadership, but he did not respond by press time.

Hunt would not comment on how Strickland had access to the Native American Student Association’s purchasing card. Students are not allowed to have access to purchasing cards, according to Ashru Shah, NC State’s P-Card manager. P-cards are strictly monitored by the P-card Program office staff.

Only NC State professors, employees and some graduate students are approved to use purchasing cards. Before obtaining one, though, they must go through a rigorous training on what can and cannot be purchased with them.

In Shah’s three years of working at the P-card program office, she has only dealt with three cases of employees or professors misusing their P-cards.

Other cases

Robert Watling, assistant dean of business operations for the College of Agricultural and Life Sciences, reported an embezzling case to University Police Jan. 26. The report states the offender embezzled $11,792.66 from the college through his P-card.

The investigation is ongoing, so University Police could not release his name. However, according to the police report the offender is a 39-year-old white male. He is no longer working for the university, according to Watling.

Major David Kelly said the suspect resigned for an unrelated issue, and afterward a review of all of the credit card purchases was conducted.

Kelly said there was a fourth case of embezzlement this semester where the university was the victim, but the case was closed after the employee was terminated and the victim did not wish to pursue criminal charges.

Moving forward

Student Involvement is in the process of creating online financial tutorials and videos that should be ready to roll by this summer, according to Deborah Felder, assistant director of Student Involvement.

This is the first time Student Involvement has created trainings specifically geared toward financial literacy, according to Felder.

“The trainings will focus on basic banking skills and what do you consider when opening a checking account,” Felder said. “We recognize that students who are handling these accounts may have never dealt with managing their own checking account.”

She said the goal is to have at least two representatives from each student organization to complete the online tutorials. Felder said educating students on financial literacy is always important, but the trainings were ultimately sparked by these reports of embezzlement.

“I can’t get around the fact that there was money embezzled from three student organizations — and it was a large sum of money,” Felder said. “Honestly, I have to commend the student that caught that. It was his practice of looking at the account that allowed him to discover this. Again, I think that looking at that, you have to say all student orgs should be checking their checking accounts.”