North Carolina college students are graduating with less college debt even as tuition has increased.

The Charlotte Business Journal recently reported that North Carolina students are graduating with lower loads of debt than their peers in other parts of the country.

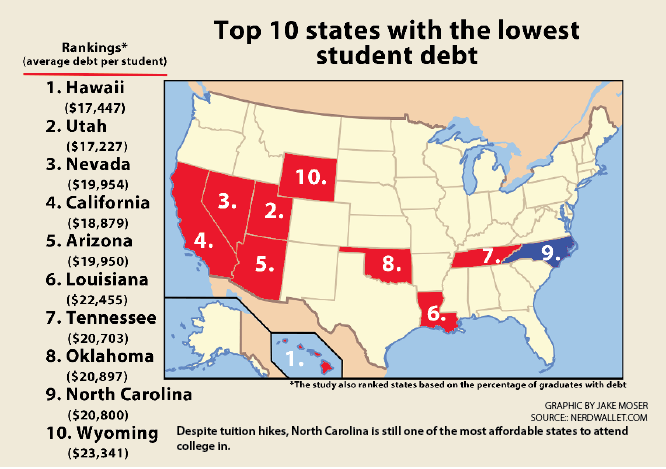

North Carolina ranks ninth among the states for student debt, with graduates carrying an average debt of $20,800.

The differences between the states with regard to student debt levels are the product of the income demographics of the states, financial aid offered by universities in the state and the availability of state grants and loans. On either end of the spectrum are Hawaii, where graduates average $17,447 in debt, and New Hampshire, with debt levels averaging $32,400.

According to the Institute for College Access and Success, a nonprofit organization that researches trends in higher education costs and availability, the economic recession, declines in state funding for higher education, the drop in the stock market and the rise of for-profit institutions all led to tuition spikes and financial hindrances for college.

The Student Aid Alliance, an organization that lobbies for greater federal student aid, recently stated that budget cuts could cost students $876 per year in new fees, fewer work-study hours and reduced grants.

“Recent polls show that Americans believe helping students pay for college is an important and desirable expenditure for the federal government,” the organization’s website says. “Investment in student aid is an investment in everyone’s future.”

Public college education in North Carolina is still affordable compared to some other states, but borrowing costs are increasing. The average cumulative student loan debt for N.C. State students was $23,697 for 2012 graduates; in 2011 it was only $18,126.

Krista Domnick, director of Scholarships and Financial Aid, said that college debt can have lasting financial effects.

“Student loan debt can affect decisions that students make post-graduation, like when or whether or not to purchase a home, begin a family or even return to graduate school to further their education,” Domnick said. “It is important for students to borrow carefully and only borrow what they need.”

The Office of Scholarships and Financial Aid offers a variety of options for students struggling financially, including the Pack Promise program, a low-debt financial aid initiative for students who need significant assistance. The Park and Caldwell scholarships are the best-known merit-based scholarships available here, but each college also offers a variety of smaller award ranging from $500 to $1,000. These scholarships are listed on the colleges’ websites.

While debt can be a burden, students say North Carolina’s status as a relatively affordable state to attend college in is comforting.

“Graduating in debt is something that no one wants to do but will pay off in the long term,” said Brittany Shore, a junior in fashion and textile management. “Because of the large amount of financial aid that I receive every year I will be better off than most students after graduating.”