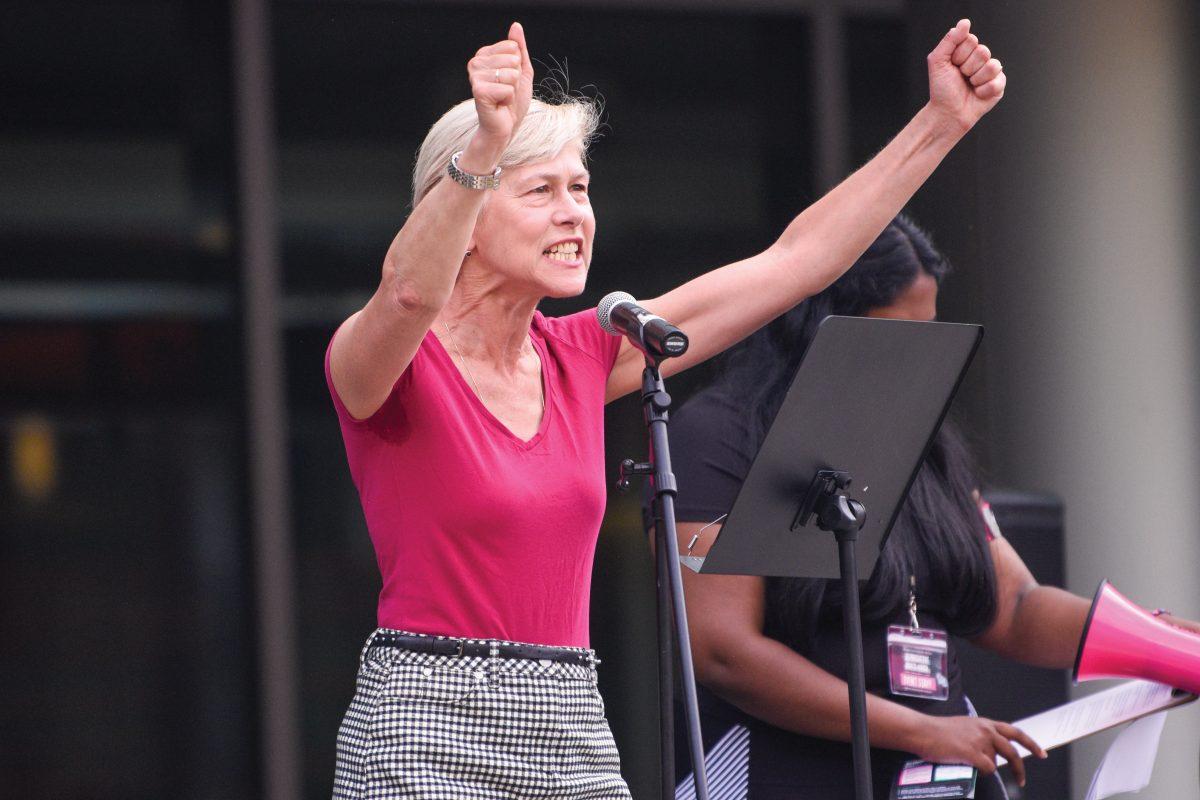

Never heard of credit? We’ve got you. When managed well, credit cards can be a vital part of building credit while in college. Melissa Hart, a senior lecturer in Finance and Hailey Amass, president of the Financial Literacy Club, gave advice for students on how to manage their credit while in college by using a credit card.

Amass, a third-year studying accounting and finance, explained credit is any money that you will have to pay back. Credit cards and student loans are examples of money that you have to borrow and pay back, in turn building credit.

“It’s important to start building good credit habits at a young age rather than waiting until it’s necessary,” Amass said. “While we aren’t buying houses right now, it is good to have an established credit history, because the longer you have credit established, the better it will look on your score over time.”

Hart said credit is important because almost everyone will need it in order to make a big purchase eventually, such as a house or a car. Credit is what will be used to evaluate one’s ability to pay back their debts, so when trying to make a major purchase later in life, the better one’s credit the better off they will be.

“Almost everyone will be making a major purchase one day,” Hart said. “If you don’t have credit when trying to make a major purchase one day, you’re either going to need a cosigner or pay a really high interest rate.”

Amass said the best way to build credit while in college is opening a credit card when you turn 18, and actually using it.

“You can find a student credit card at many banks, and then use it for any purchase rather than paying with cash or a debit card, then paying it back immediately,” Amass said. “Use it as you would cash and live within your means, don’t overspend and it will build your credit.”

According to Hart, a small piece of credit score is length of credit, but the majority is payment history, so student credit cards are a great way to build credit in college.

“The FICO score has two pieces in it which represent 65% of your credit score, the first being payment history,” Hart said. “There is only one way to have payment history, and that is to actually have credit.”

Hart said college students often shy away from credit cards because of the fear of overspending or spending money they don’t have, but a little self-control will go a long way in terms of building credit.

“This is the part that I think scares college students the most: if they give you a credit line, what if you spend it all?” Hart said. “You need to have a bit of restraint but even if you did spend the max, it would take you a long time to pay it off but you’d have a great payment history.”

Amass said the best resource for students on campus is the PNC bank in Talley Student Union, located on the second floor.

“It’s really convenient with its location, and they have a lot of options for students to start building their credit,” Amass said.

Ultimately, both Hart and Amass advise students to find a credit card best suited to their lifestyle and personality as a way to build credit and prepare for life after college.

“Understand what your limits are, if you’re a saver or a spender, and knowing yourself can really pair well with what you’re trying to do with your credit,” Hart said. “Know yourself and know your circumstances.”