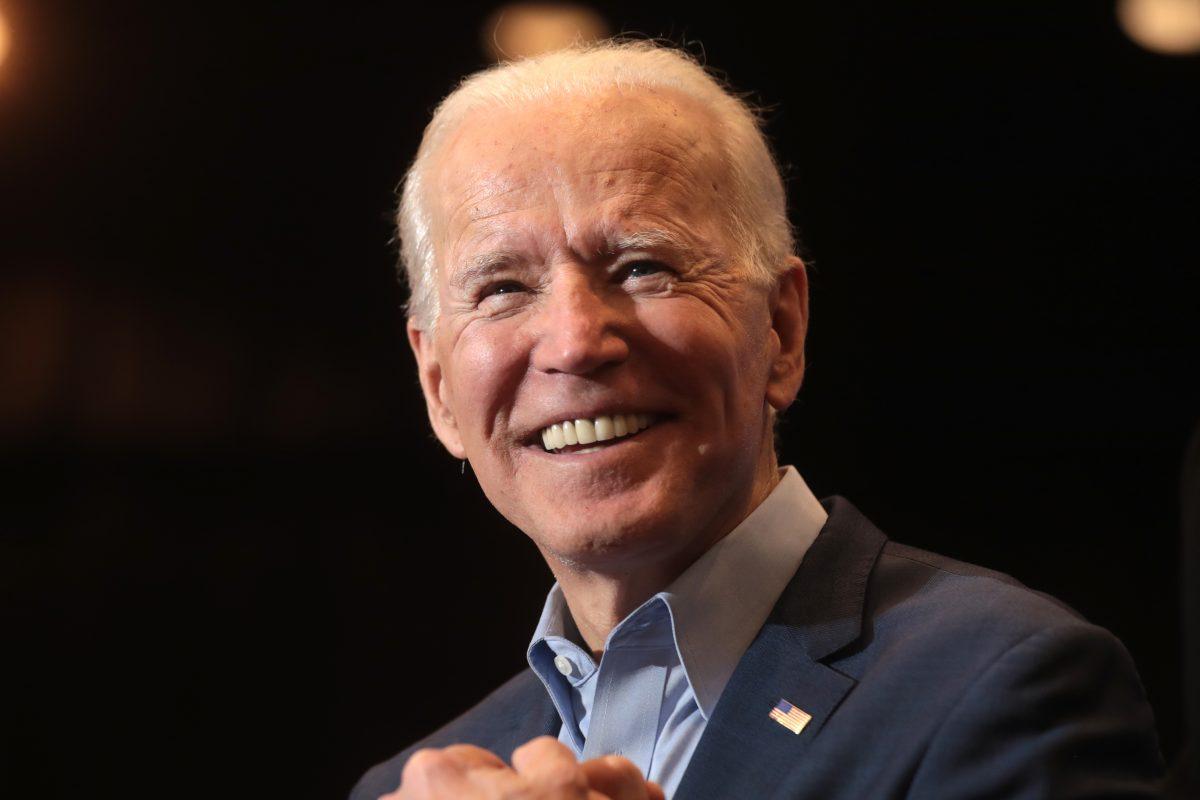

President Biden’s administration has announced a plan to help those with student loan debt transition into regular payments again as the pandemic-related loan repayment pause comes to an end on Dec. 31, 2022. This plan includes student loan forgiveness for middle and low income families.

According to Krista Ringler, associate vice provost and director of enrollment management and services, many details about the operational aspect of Biden’s plan have not come out yet, but the income limits in order to qualify for student loan forgiveness have been set. Individuals making $125,000 or less annually and married couples making $250,000 or less annually qualify for up to $20,000 in loan forgiveness.

“The $20,000 mark is for students who received federal Pell Grants while they were in school; students who meet the income limits but did not receive Federal Pell Grants while they were in school can receive up to $10,000 in student loan forgiveness,” Ringler said.

This income threshold is referring to the student or the student’s parents’ salary when they began college, rather than what they currently make now, according to Ringler.

“It’s a really complicated question, but it was the family income when they were a student when they were applying for aid,” Ringler said. “Now, the particulars of how you apply for aid and the year of income we’re looking at are somewhat complicated. But for traditional students who were providing parental information when they applied for aid, it would have been their parents income at the point they were attending school. So it does not matter what they make now at all if they had a Pell Grant.”

According to Jamie Pendergrass, senior assistant director of enrollment management and services, universities typically give Federal Pell Grants to the students in the lowest income range that the university accepts.

“A student who has been graduated for 10 years now may still have student loans, and perhaps they’re doing very well now, but maybe it was a struggle while they were in school,” Pendergrass said. “They received a Pell Grant while they were in school and now meet the current income limits in the legislation. They could get up to $20,000 in relief.”

Biden’s current plan does not affect undergraduate students that still currently use federal aid, as loans that are eligible for forgiveness consideration had to have been dispersed before June 30, 2022, Ringler said.

“For all of our freshmen that began this fall, their loans were disbursed after that date,” Ringler said. “And assuming they were not enrolled elsewhere prior to that date, they don’t have any federal loan debt.”

According to Ringler, because all loan forgiveness only applies to federal loans, there is no immediate impact on individual universities.

“Coupled with this legislation is the expectation that universities be mindful about costs,” Ringler said. “Now, traditionally, NC State has done a very good job at keeping tuition expenses very low for students. You know, there’s not been an increase for in-state students for quite some time now.”

In the past, forgiven loans could be classified as income and taxed as such. According to Pendergrass, the loan relief money will not be subject to federal taxes.

“This forgiveness is not going to be part of that, but state and local taxes could apply,” Pendergrass said. “Now, North Carolina does not have this [in legislation] and so it won’t be part of anybody who’s in North Carolina residence taxes. But any of our out-of-state students who might be receiving forgiveness will need to be mindful of their individual state and if they have to pay taxes on it. That’s one thing that they would need to be mindful of.”

According to Ringler, there is no way for students to maximize or earn money through loan forgiveness. If an individual qualifies for maximum amount in loan forgiveness but owes below that amount, they will only receive funding for what they still owe.

“So for a student who owes only $7,000 in loans right now, and they do qualify for loan relief, they would only get $7,000 rather than $10[000],” Ringler said. “So there is no maximizing or cashing out additional relief, it’s only the amount that you’re still up to the limits that the federal government has outlined.”

Those with student loans must apply to be in this program and will continue to have to make payments after Dec. 31, 2022 if they have not applied by then, Ringler said.

“I think the biggest thing is just to stay apprised of information as it comes out,” Ringler said. “That’s what we’re doing. Every day we receive releases of information, and we’re just trying to stay up to date. I think that’s the best thing that students and taxpayers can do while they’re waiting to see how this actually rolls out. And then once the process is clear, people should move quickly, to take advantage of this as quickly as possible.”

Visit here for more information on federal student loans and qualifications for student loan forgiveness.