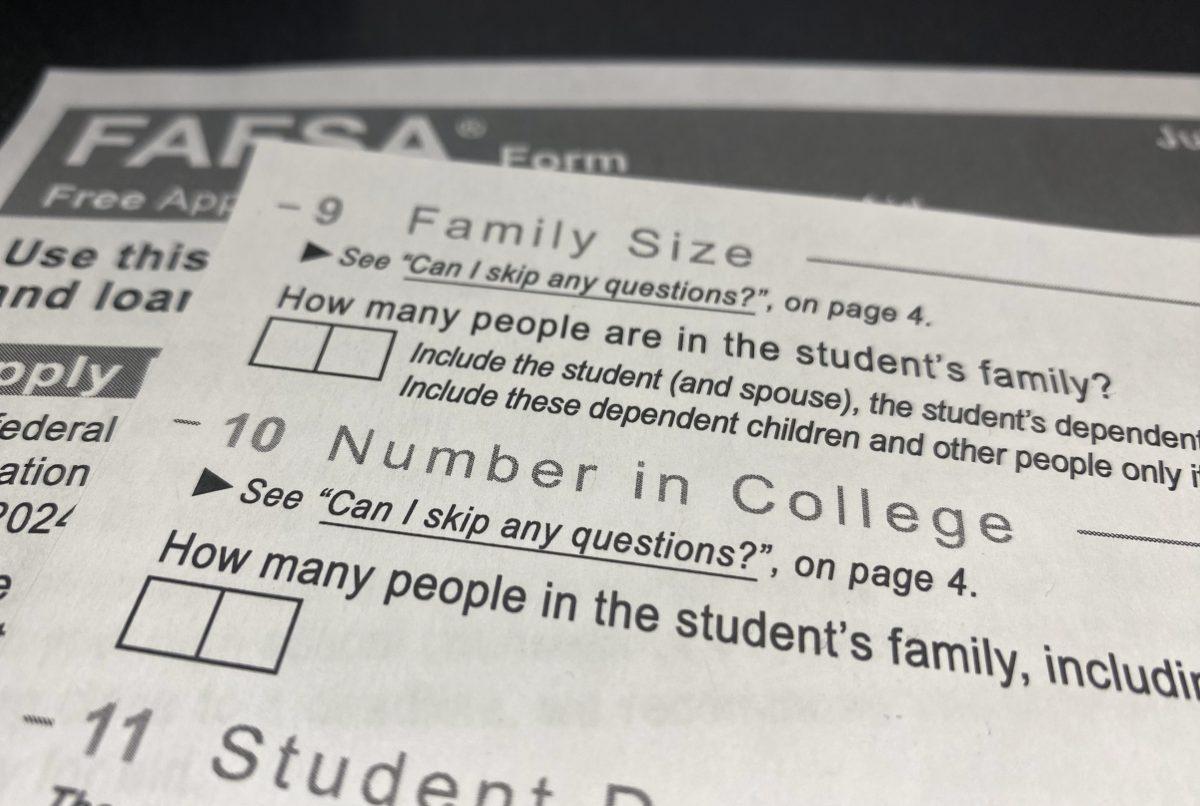

A redesign of the Free Application for Student Aid form for the 2024-25 cycle is posing issues for students across the nation who struggled to access the form on the typical release day or are concerned about a change in their financial aid. In response, NC State extended the priority FAFSA deadline to March 1.

Krista Ringler, associate vice provost and director of Scholarships and Financial Aid, said the former FAFSA system was overhauled to streamline the process and encourage more students to fill out the form. However, bugs in the system appear to be posing difficulties for some students attempting to apply for financial aid.

“The positives of that redesign is there are fewer questions that students are presented with,” Ringler said. “So in theory, students can get through much more quickly. Some students are encountering some issues, though, once they enter the form.”

FAFSA was also released later in the cycle than in previous years due to the extensive overhaul. The form was available on a restricted “soft-launch” basis at the start of 2024.

Ringler said the reason for the delay was the redesign of the form. Because federal statute states that FAFSA must be released by the last day of December of each calendar year, the Department of Education was legally required to launch the form. Because the system was not yet ready, it was released on a limited basis to account for traffic.

Typically, the Department of Education urges students to fill out the form as soon as possible, reminding them that aid is awarded on a first-come, first-served basis. Because of these delays and restrictions with the system, though, it was not able to push the same message this cycle.

“They had to kind of walk back a little bit with that urgency to complete your FAFSA,” Ringler said. “The new language was, ‘You still have time.’ And we want students to understand they do still have time.”

When the Department of Education redesigned the system, it redesigned the methodology used to determine eligibility for federal financial aid. While this was intended to expand federal aid, Ringler acknowledged that some students may see a decrease in eligibility.

“A benefit of the complete overhaul of the process in the back-end methodology that determines eligibility is that we expect more students will become eligible for federal Pell grants,” Ringler said. “So we do anticipate that there’ll be an increase in eligibility for some students based on their financials. There were some other changes to the methodology that could result in some students being eligible for less.”

Ringler said some changes in the methodology could result in students being granted less financial aid, such as the “sibling discount.”

The “sibling discount” previously provided a financial adjustment to the expected family contribution of families with multiple children in college. It is anticipated that the removal of this discount is likely to impact middle and high-income families the most, changing their eligibility for federal aid.

Ringler said the removal of the “sibling discount” was just one of many changes made to the formula, and likely would not be the sole determinant of any changes students and families may see in their financial eligibility.

“There were so many other changes to the formula that in some ways, the expectation is perhaps some of these families will already see a plus-up given the change in the formula,” Ringler said. “So perhaps it won’t have as much of an effect. You can’t just say it’s a one-for-one change because of all the other factors that have changed in the formula.”

Jamie Pendergrass, associate director of Scholarships and Financial Aid, said the new formula would ideally work in the favor of most students.

“All these changes are brought about by the law that Congress passed, so one would hope that they listened to financial aid administrators as a part of their deliberations in passing the bill,” Pendergrass said. “But ultimately, this is what they decided on.”

Pendergrass said the new FAFSA form and methodology are here to stay, but this will be the worst the system will ever be.

“The Department of Education has every incentive to do better because, not only have they heard from the professional community and the financial aid administrators, but they have heard considerably from the students and families that are having difficulties in the frustration,” Pendergrass said. “So I think they have every incentive to try to do better for 2025.”

Ringler said the impact of these changes to FAFSA for the 2024-25 cycle will not be clear until financial aid is provided to students, but financial aid offices are anticipating different groups of students seeing potentially different impacts.

“We don’t have any results from the FAFSA yet to really see what the on-the-ground impact is for all of our students,” Ringler said. “For many students, it’s a good thing — more eligibility and more Pell. But there will be pockets of students that might see some impacts that we need to be aware of.”

For assistance with completing the FAFSA, visit or contact NC State’s Scholarships and Financial Aid Office. To see all updates provided by FAFSA in real time, visit the Student Services Center’s FAFSA simplification page.