North Carolina’s new tax law has been in effect for more than a year. In 2013, our Republican-controlled state legislature overhauled the previous progressive tax system. What has replaced this progressivity is a lower corporate tax rate and a lower, flat income tax rate for all.

The Republicans intended to boost the state’s long-time low-ranking business environment and effective tax burden by lowering the corporate income tax to attract more investments and raise employment.

Unfortunately, the Republicans took a simple and controversial approach to the personal income tax rate, answering with a flat tax rate for all, which aims to simplify the cumbersome tax codes and processes. The flat tax rate was once a celebrated idea of reforming the disgracefully complicated federal income tax system. Recall how 2012 presidential candidate Herman Cain’s “9-9-9” flat tax rate proposal sparked the public awareness of how unfair and burdensome our tax system has become since the passing of the Tax Reform Act of 1986.

To this end, the flat-rate approach does not simplify the tax code. Instead, it drastically reduces the progressivity of our tax system. Simply because a tax system is moderately progressive does not mean it is necessarily complex. Progressivity is not to blame. Instead, we should re-examine all those thousands of categories of exemptions, tax credits and deductions that require extensive taxpayer effort to figure out what the right taxable income is. In addition, higher income households usually have more motivation to apply these exemptions and deductions more frequently than lower income households in order to lower their effective tax rates as a whole.

Secondly, a flat rate would not hold accountable all the households among those in the top income percentile that have their income source diversified by holding different types of financial assets such as equities, stocks and real estate. Under the current tax structure, different types of income fall into distinct zones of tax rates. One highly cited example in the media was that Mitt Romney’s effective tax rate in 2012 was allegedly even lower than his secretary’s. This was displayed when President Barack Obama disclosed his tax information to the public as well.

These surprising details are, in fact, not unusual at all. The differentiated tax rates on capital gains effectively eliminate the nature of the progressive tax system. The current federal marginal tax rate can increase to 20 percent, and the states even add a rate on top of that, according to the Tax Foundation. Take North Carolina as an example—the top marginal tax rate for capital income amounts to 28.5 percent, whereas the top marginal tax rate before the tax overhaul was 48.6 percent, much higher than the capital income tax. The large share of income of the middle class is from wage, which is subject to a higher rate than capital income.

In a progressive tax system, the lower brackets of taxpayers are virtually insignificant to high-income taxpayers. Only the top marginal rates are relevant. Someone with a $10 million income pays nearly $3.5 million in taxes under the current structure with a 35 percent top rate, but under a 23 percent flat rate, the tax drops to $2.3 million. For middle or low-income households, effective tax rates depend on the exemptions. A married couple with a $50,000 income pre-tax pays nothing under a flat 28 percent tax rate with exemptions. However, with a 20 percent rate, the couple could pay up to $10,000 with no exemptions.

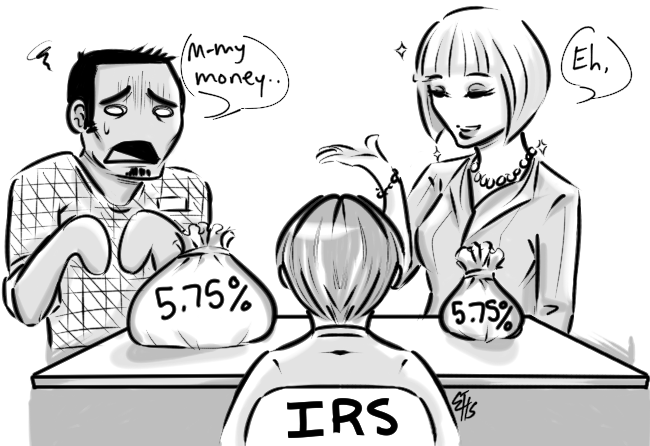

If Republicans tend to give tax favors to the high-income taxpayers, they simply lower the top marginal income tax rates above some certain threshold, leaving the lower brackets intact. Though the new flat rate of 5.75 percent is slightly lower than the previous rate in the lowest bracket of 6 percent, it should have advanced to a fairer and more efficient income tax system such as what Hong Kong has.

Hong Kong’s moderately progressive personal tax system has been praised for its efficiency, clarity and fairness. Approximately 60 percent of the population doesn’t pay any income tax whatsoever. The lowest bracket rate for wage income is as low as 2 percent. The top rate is not significantly high either, with 17 percent for portions exceeding 120,000 HK dollars. There are also a few major exemptions programs based on family affairs. Such a tax system balances the need of taking care of the poor and preventing over-punishment for the rich. This example is what our state lawmakers should learn from.

Ziyi Mai is a graduate student studying economics.