Money is a touchy topic—especially in college. For me, after attending community-based public schools for my primary education, moving into my dorm at NC State freshman year was one of the first times I faced a diverse population of people, all from different backgrounds and incomes.

Over the past few years, I’ve observed the different divisions of the “broke college student.” The first consists of students who consider themselves broke because it is the first time they have ever had to budget; the second consists of those who are truly broke and only have $5 in their checking accounts.

There is a significant divide between students who constantly worry about money and those who don’t. Stress caused by financial instability influences your studies a great deal; it plays a contributing factor in determining your major. I know students who pick majors because they know that they need a substantial starting salary to pay off college loans. Money also factors in to whether you choose options such as studying abroad or Alternative Service Breaks. Your finances decide whether you attend graduate school.

Money also affects the psyche of the college student. Paying your own way might induce you to try harder because you understand the value of the classes you are paying for, or it might cause you to crumble with the stress of balancing both working and school. Not having to worry about where your payments come from either allows you to be more focused or causes you to slack off because you don’t really think much about the cost of it all.

On a daily basis, I come across those who could be on full scholarships struggling to make tuition payments or working long hours. Many students pay for everything themselves, while others rely on their parents. I have friends who have high-paying internships, and many more who work minimum wage jobs. Even what is owed to the university varies, and everyone’s tuition bill is unique.

Forty-eight percent of NC State students receive student loans, averaging at about $5,565 according to a statistic by Niche. This statistic neatly divides our student body into the “haves” and the “have nots.”

Social stratification becomes much more pronounced in college. The students who have piles of student loans looming over their twenties have very different priorities than the students who are lucky enough to start off a career with a clean financial slate. Students who either come from wealthy families, or are blessed with scholarships, enter the workforce on much more stable financial footing than those who don’t.

“College-educated adults without student debt have a typical household net worth of $64,700, or about seven times the household wealth of a college-educated adult paying off student loans, at about $8,700,” according to a new analysis from the Pew Research Center. This goes to show that doing well in college and getting a well-paying job after graduation does not ensure financial success.

Furthermore, in college, students divide themselves into socioeconomic groups based on major. This may not be true across all fields of study, but, for example, an education major has very clearly declared their financial future to be different from the financial possibilities of a peer who is an engineering major. These divides create subtle frictions between majors.

Even students within a particular major experience segregation. It is not just the proximity to one another that perpetuates the relevance of class differences, but also an aversion to being uncomfortable around those of different socioeconomic status. Involvement in expensive Greek organizations can also further segregate these classes.

Monetary issues can breed a lot of resentment among friends. Financial disparity rears its ugly head when friends decide to apartment-hunt, brainstorm spring-break trips and coordinate group reservations at restaurants.

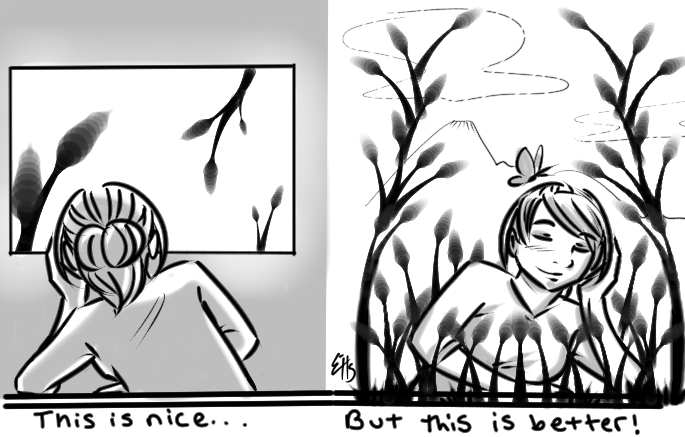

Even in a public university like NC State, money is a huge deal. As we begin to face the real world, inequalities become more and more distinct.

Education, which is supposed to be the ultimate equalizer, truly is not. Talking about money makes most people uncomfortable because it brings attention to our inequality. The stratification among students is often unspoken, but chiefly and excessively present. The fact is, we are not one, solidified “Wolfpack.” Our financial demographics make it difficult to produce a candid camaraderie.

Money is an uncomfortable topic for many, and I advocate for more frequent, realistic discussions about the reality of this type of diversity on campus. Our university does do a good job with needs-based grants and programs like work-studies; however, this is simply a Band-Aid on a much deeper issue. The inner workings of universities in the United States are deeply classist, despite the efforts to promote equal opportunity. The success of the educational system in the U.S. should not be based on anecdotes about the outliers who overcame adversity, but instead on stories about the average student who didn’t get so lucky.